China Oil Refiners Risk Iraq’s Wrath With Rare Kurdish Buys

Petrotahlil :China’s independent refiners are buying oil from Iraq’s semi-autonomous Kurdistan region as they scour the globe for cheaper crude to cope with margins near record lows.

Kurdish oil is typically traded under the radar as buyers fear incurring the wrath of Iraq’s state-owned SOMO, which markets grades of a similar quality, said six traders and refiners who buy and sell Middle Eastern crude. That helps push down the price of the oil, which is sent by pipeline to the Turkish port of Ceyhan before being shipped from there.

Dongying Qirun Chemical Co Ltd., Dongying Haike Ruilin Chemical Co Ltd. and at least two other Chinese refiners bought Kurdish crude for loading in November and December, said four traders who asked not to be identified due to company policy. Chinese buyers have purchased only three Kurdish cargoes in the first half of this year and none in 2018, data compiled by Bloomberg show.

Asian demand for medium-density oil with a high-sulfur content -- such as that produced in Kurdistan -- is growing due to a wave of state-of-the-art refineries starting up across the region. These plants are better equipped to process lower-quality crudes into gasoline, diesel and shipping fuel than their counterparts in Europe. They’re also able to produce cleaner-burning ship fuel mandated by International Maritime Organisation rules that take effect Jan. 1.

However, those new refineries have -- along with elevated freight rates and slowing economic growth -- conspired to push down margins for processors in Asia. Complex refining profits in the regional processing hub of Singapore plunged from more than $10 a barrel in September to a record low of -$1.87 late last month, according to data from Oil Analytics. Returns were at -82 cents on Tuesday.

See also: Asia Oil Refiners Resist Run Cuts Despite Record-Low Margins

“There will be healthy Chinese appetite for grades such as Kurdish oil as new complex refineries that are equipped to process medium-sour crude ramp up, especially if the price is attractive,” said Li Li, research director at ICIS-China. “Fuel margins have been weak so far this year, so it’s all the more reason to scout for cheap feedstock.”

Vessel Tracking

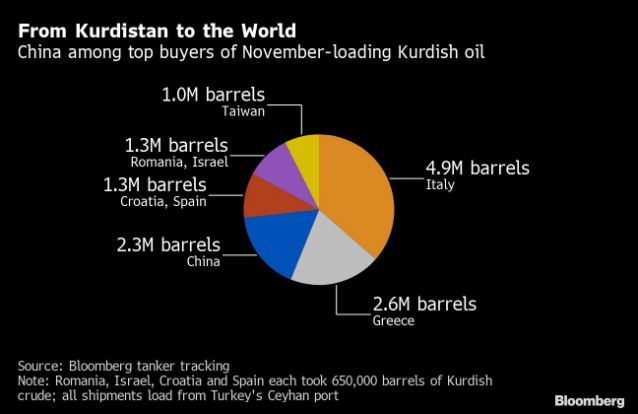

Tankers Atlantic Explorer, Minerva Vera and Guanabara loaded a combined 2.3 million barrels of Kurdish crude last month, according to ship-tracking data. The first vessel has already offloaded its cargo in China and the other two are set to later this month. Poliegos and Ottoman Nobility loaded shipments of Kurdish oil in December and are currently on their way to Asia.

The Kurdish oil headed to China was priced at $2 to $3 a barrel above global benchmark Brent, the traders said. That compares with similar-quality Oman crude that was priced at $2 a barrel or more than the grade from Kurdistan.

An operator at the front desk of Dongying Haike Ruilin Chemical declined to comment when contacted by phone. Dongying Qirun Chemical didn’t reply to an email seeking comment.

Companies that buy Iraqi Basrah Light and Basrah Heavy from SOMO are unlikely to consider Kurdish purchases for fear of jeopardizing their access to those supplies, said the traders. Iraq is OPEC’s second-largest producer after Saudi Arabia. Kurdish crude made up about 11% of the nation’s 3.97 million barrels of day of exports last month, according to data compiled by Bloomberg.

Follow us on twitter @petrotahlil

Source :Yahoo finance

END